Exploring Long Call Options in the Indian Market : A European Perspective

Understanding Long Call Options

In the Indian financial market, long call options in the European style present a unique opportunity for investors to participate in potential price movements of underlying assets. Unlike American options, which can be exercised at any time before expiration, European options can only be exercised at expiration. This characteristic shapes the dynamics of trading strategies and risk management techniques employed by investors. Confidence, Approach option trading with confidence, armed with knowledge, skills, and a sound strategy. Wealth creation, Harness the potential of options to create wealth and achieve financial independence.

Mechanics of Long Call Options

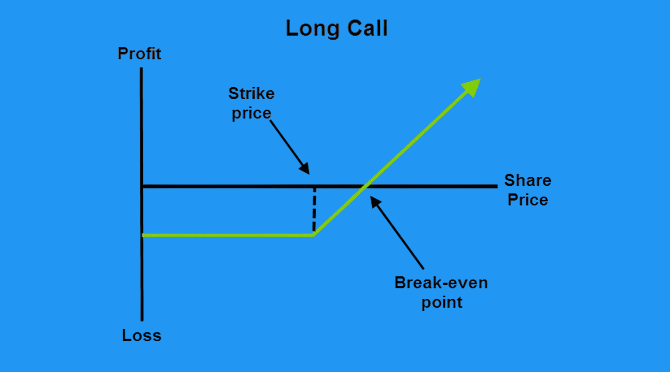

Long call options provide investors with the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) upon expiration. Investors pay a premium upfront for this privilege, aiming to profit from an increase in the value of the underlying asset beyond the strike price before the option expires. This asymmetrical risk-reward profile makes long call options an attractive tool for speculating on bullish market trends.

Advantages of Long Call Options in the Indian Market

Long call options offer several advantages for investors operating in the Indian market. Firstly, they provide a cost-effective means of gaining exposure to high-priced assets, such as stocks or indices, without the need for substantial capital investment. This accessibility makes long call options particularly appealing to retail investors seeking to diversify their portfolios or capitalize on specific market opportunities.

Cost-Effectiveness and Accessibility

By paying a premium upfront, investors can leverage long call options to amplify their potential returns in bullish market conditions. As the price of the underlying asset rises, the value of the option increases, allowing investors to profit from the price difference between the strike price and the market price at expiration. This cost-effective approach enables investors to participate in market upside while limiting their downside risk.

Considerations for Trading Long Call Options

While long call options offer enticing opportunities, investors must carefully consider various factors when implementing this strategy in the Indian market. Market liquidity, volatility, and regulatory frameworks can significantly impact option pricing and execution, requiring investors to conduct thorough analysis and risk management.

Market Dynamics and Risk Management

Timing plays a crucial role in maximizing the effectiveness of long call options. Investors must assess market trends, volatility levels, and macroeconomic factors to determine optimal entry and exit points for their positions. Additionally, implementing hedging strategies, such as buying protective puts or employing stop-loss orders, can help mitigate downside risk and preserve capital in adverse market conditions.

In conclusion, long call options in the European style offer a compelling avenue for investors in the Indian market to capitalize on price movements while managing risk effectively. By understanding the mechanics of long call options, considering market dynamics, and implementing robust risk management strategies, investors can harness the potential of this versatile financial instrument to enhance their investment portfolios and achieve their financial objectives.